My long-standing skepticism about survey data has reached the point where I feel compelled to comment on the current state of the art. While it is always risky to ignore broad, deep, and reliable surveys, I’m following up on a few prior sentiment posts.

First off, we are not discussing online surveys; those are easily gamed and worthless. Rather, I am discussing the regular surveys that come to people through their landlines, texts, and mobile phones.

WhoTF answers these? Who has the time or interest to respond to a random person calling you and interrupting whatever you’re doing to ask a series of questions about the economy? This is a subgroup of people who probably aren’t working or at least aren’t working very hard or busily, and are free to make up whatever they want.

As if polling isn’t bad enough, there is a specific cohort that has been gaming pollsters for years. A recent poll showed that 17% of respondents believe Joe Biden was responsible for overturning Roe v. Wade(!). I have to call bullshit on this. I don’t care how dumb you think the public is, but you simply cannot believe nearly 1 in 5 are that utterly clueless. These are partisans trolling pollsters for shits & giggles, full stop.

Anytime you trash polling data, you run the risk of missing a major shift in sentiment. Recall in July 2008 when Phil Gramm called America a “Nation of Whiners,” and said we were in a a “mental recession.” At the time, Housing had peaked 2 years prior and was crashing, we were 8 months into what would become not only the worst recession since the Great Depression, but snowball into the Great Financial Crisis (GFC).

A couple of years ago, I asked if it made any sense that that current sentiment readings are worse than:

1980-82 Double Dip Recession

1987 Crash

1990 Recession

9/11 Terrorist Attacks

2000-2003 Dotcom implosion

2007-09 Great Financial Crisis

2020 Pandemic Panic

Sorry, but this is also more nonsensical bullshit.

Some of the blame belongs to the media and a particularly insidious form of journalistic malpractice. Every time I see an interview of a pollster on TV, I wait for the questions but they never seem to come. Two examples of this dereliction of duty:

First, if it’s an economic poll, I want the interviewer to ask something along the lines of:

“You’ve been doing this poll for XX years; what has this reading meant in the past for subsequent market performance?” If they cannot answer that question, what value is that economic poll? “

For example, I first asked if partisanship was driving sentiment ~2 years ago (August 9, 2022); since then, the S&P 500 is up 28.6% and the Nasdaq is 45.6% higher. Rather than scare investors out of markets, this puts sentiment readings into proper context.

Second, if economic polling is bad, political polling is worse. We have been deluged with polling data from 15 months prior to the November 2024 election. The journalistic malpractice here is even worse.

Every interview with a pollster discussing the presidential election should ALWAYS ask these questions:

1. How were your polling results relative to the outcome in the 2020 election? 2016?

2. How prescient are polls this far in advance of the election? What is their accuracy, 3, 6, 12, 15 months out?

3. When are your polls most accurate? 7 days? 2 weeks? Where is your sweet spot?

It is kind of astounding that despite the polls blowing it year after year, the media still seems to still hang on every one of them. It’s always more about a sensationalistic horse race, than policies or governance. As a reminder, polls blew the 2016 Trump election, they underestimated Biden’s 2020 margin of victory, and they completely blew the “Red Wave” in 2022 that never arrived.

Any fund manager with a track record that poor would have been fired long ago.

We all understand the economy is complicated and strength in consumer spending and wage growth are not evenly distributed. Especially at extremes, we disregard sentiment data at our peril. But when I look at specifics across the economy, I cannot help but notice that across each quartile of consumer spending, demand continues to overwhelm supply:

-Restaurant reservations are increasingly difficult to get; even moderately popular spots require 2 or 3 weeks advance notice;

-Airline tickets to popular destinations must be purchased many months in advance.

-New Car purchases continue to take much longer to arrive than normal; High end cars (Porsche, Ferrari, etc.) are sold out for a year.

-Boats of many sizes also have delays for deliveries;

-We still have a huge shortfall of single family homes;

– Wage gains have outpaced inflation since the pandemic began;

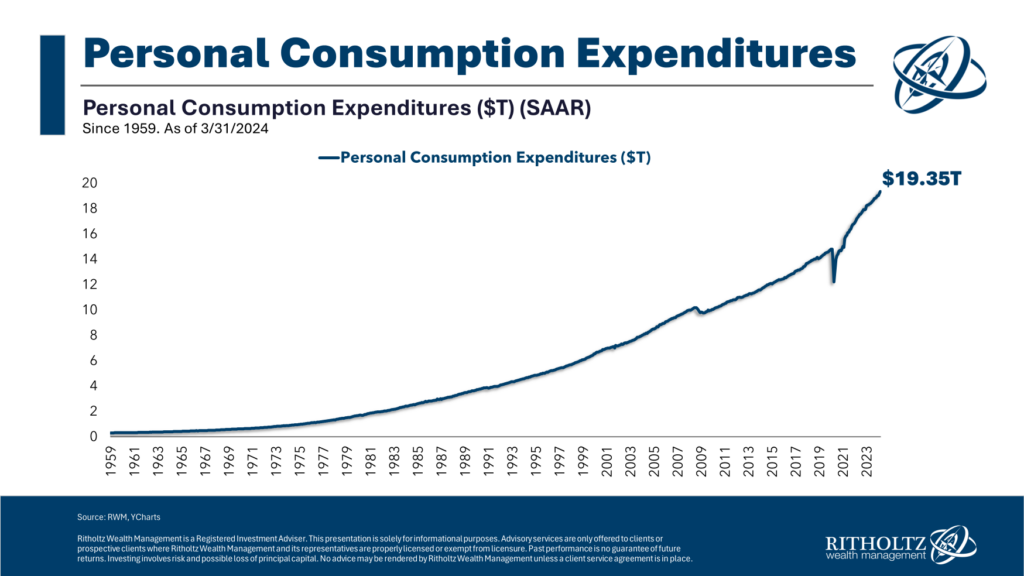

-Consumer spending is at record highs (See chart, top)…

I went to a local BBQ/Car Show this weekend, and I got dragged into a conversation about “how lousy the economy is.”

Rather than inundating people with data (see below), I asked some questions: Where did you guys go on your last vacation? (It ranged from Disney to the Greek islands to Bali) How is your business? (uniformly Booming). How many people have you hired since the pandemic ended? (5-50). What car did you drive here? (Porsche, Ferrari, Vette, vintage 1950s, Viper, not a junker in the crowd). What is your Daily Driver? (Benz, Lexus, BMW, Range Rover). How much more is primary residence worth today than a decade ago? (anywhere from +$1m to + $5m) How many homes do you own? (between 1 and 5). How many cars do you own? (2 to 400) Tell me about your boat (28-foot sailboat local to a 75-footer in Palm Beach).

Gee, it sounds like you guys are really struggling…

I get that if you are in the bottom quartile, you face difficult challenges; but the bottom quartile always has a harder time. But overall, looking at the economic data, I see record consumer spending, unemployment under 4% for two years, lots of new jobs created, inflation way down from its fiscal stimulus surge, wages up, and the stock market at all-time highs. That’s not merely an okay economy, but an excellent one.

I cannot help but be reminded of the Ralph Waldo Emerson quote my father was so fond of admonishing me with: “What you do speaks so loudly I cannot hear what you are saying.”

Previously:Wages & Inflation Since COVID-19 (April 29, 2024)

Is Partisanship Driving Consumer Sentiment? (August 9, 2022)

Quote of the Day: Phil Gramm (December 10, 2008)