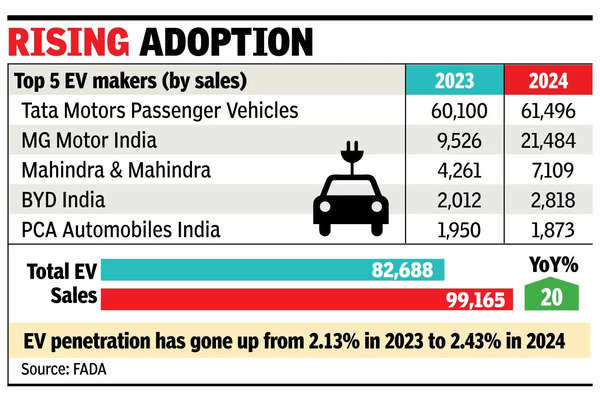

NEW DELHI: Price cuts towards end of 2024 saw sales of electric cars rise 20%, with the industry’s volumes finishing a shade lower than one lakh units against 82,688 units in the previous year.The growth comes despite doubts about a mass adoption for EVs as customers complain over a poor public charging infrastructure, longevity of battery, and resale price of the vehicles after a few years.Retail numbers sourced from dealer association Federation of Automobile Dealers Associations (FADA), shows electric vehicles finished 2024 with a share of 2.4% in total auto retail of 40.7 lakh units. This share was 2.1% in 2023.Internal combustion engine (ICE) vehicles (those powered by petrol, petrol-CNG, petrol-battery (hybrids) and diesels) continued to have lion’s share, bringing out the fact that it is still a long way to go for EVs in their quest for a sizeable market size.Tata Motors’ continued to lead the EV market with sales of 61,496 units in 2024 (60,100 in 2023), even though its market share in electrics dropped to 62% against 73% in the previous year. Tata sells electric versions of an array of ICE models, which include Tiago hatch, Tigor sedan, Punch mini SUV, and Nexon and Curvv SUVs. The company is likely to up the ante this year, with electric versions expected for Harrier and Safari, apart from new launch Sierra (all SUVs).

JSW MG Motor was the second-ranked in EV sales as it saw 125% growth in 2024 at 21,484 units against 9,526 units in previous year. The company’s surge was led by launch of Windsor SUV that came with a ‘battery as a service’ or battery rental model, which enabled it to lower the threshold of EV acquisition. “2024 marked a year of transformation for us. We registered an outstanding growth, with Windsor EV emerging as market leader and becoming highest-selling electric car for three consecutive months. We are committed to introducing new products every six months,” JSW MG said.However, both Tata Motors and JSW MG engaged in significant price cuts in 2024 to attract buyers for EVs, especially when demand was slowing down and new sales were facing challenges.Industry analysts said EV sales may see a significant growth this year, with a host of mega launches planned by biggies, such as Maruti Suzuki and Hyundai. Maruti will debut in EV market with eVitara (which will also be purchased by its tech partner Toyota), while Hyundai is set to drive in an electric version of its popular Creta SUV. Mahindra and Mahindra will also start sales of two all-new electric models – BE6 and XEV 9e – this year, and hopes to generate significant demand for the EV-only models. The industry is also hoping that incentives offered by govt for setting up fast charging network will help attract more buyers in clean mobility space.