Dubai led prime residential capital value growth, increasing 17.4% in 2023, versus the average 2.2% across the 30 cities monitored by Savills.

Sydney and Dubai are forecast to be the two top performers for the year ahead, with both cities set to benefit from the increase in their high-net-worth population.

Savills anticipates prices to grow in Dubai by a further 4%-5.9% in 2024.

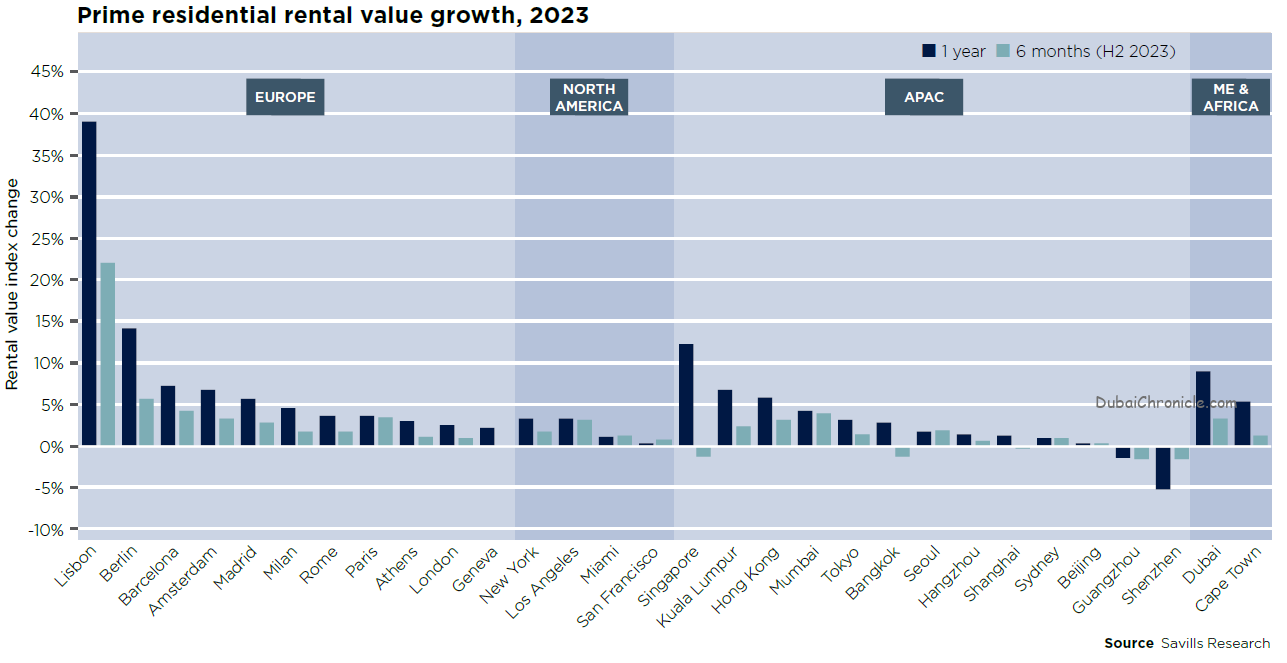

Dubai also recorded rental price increases during the year at a little under 10%, versus the average 5.1% across other global cities.

Dubai continues to be the hottest prime residential property market, with capital values increasing 17.4% for the year, with a more modest 5.6% recorded in the second half. This performance is recorded against an average price growth of 2.2% across 30 global cities covered in the Savills Prime Residential World Cities Index.

The (Dubai) market is still relatively competitively priced by global standards, at $850 per square foot, offers a comparatively low cost of living, a relatively easy visa process, and a warmer climate, which continues to attract international and domestic buyers, Savills researchers said in the report.

Other Asia Pacific cities led capital values growth in 2023, with Mumbai leading the pack. Meanwhile, some cities felt global economic turbulence more than others, particularly in the second half of 2023. New York and San Francisco, with the former seeing a muted return to office and the latter still weathering tech-turbulence, recorded some declines for the full year. Hong Kong’s ongoing political and economic uncertainty continued to hamper its prime residential markets, with capital values falling 3.7% over the year.

Looking ahead into 2024, capital values for global cities will remain in positive territory, Savills says. Prime residential price growth of a modest 0.6% is forecast across the 30 global cities monitored by Savills, down from the 2.2% achieved in 2023.

“In the face of ongoing economic uncertainty and a higher interest rate environment, prime residential markets in world cities were muted in 2023 following two years of significant gains. Growth is forecast to slow further in 2024 as markets return to more normal conditions, but will broadly remain in positive territory,” said Kelcie Sellers, Associate, Savills World Research.

Sydney and Dubai to see the strongest forecast growth in 2024

Sydney and Dubai are forecast to be the two top performers for the year ahead, with both cities set to benefit from increases in their high-net-worth populations. Sydney is seeing high levels of demand for quality prime homes, but supply remains low. It’s likely that this imbalance will persist through 2024 and push up prices, which are forecast to increase by 8%-9.9%.

Dubai increased by a significant 17.4% over the year, but it’s likely that this rate of growth will slow this year as it returns to more normal activity. Savills anticipates prices to grow in the emirate by a further 4%-5.9%.

Savills World Cities Prime Residential Index: 2023 prime capital value growth forecast vs capital growth value in 2023

City

2024 Forecast

Capital value growth in 2023

Prime capital value Dec 2023 (US$ psf)

Sydney

+8% to 9.9%

6.8%

$ 1,830

Dubai

+4% to 5.9%

17.4%

$ 750

Cape Town

+2% to 3.9%

3.1%

$ 250

Tokyo

+2% to 3.9%

8.2%

$ 1,950

Rome

+2% to 3.9%

3.3%

$ 1,410

Kuala Lumpur

+2% to 3.9%

-1.0%

$ 250

Athens

+2% to 3.9%

6.1%

$ 1,130

Madrid

+2% to 3.9%

4.0%

$ 750

Barcelona

+2% to 3.9%

3.4%

$ 680

Amsterdam

+2% to 3.9%

-2.4%

$ 960

Geneva

>0% to 1.9%

1.8%

$ 2,550

Milan

>0% to 1.9%

2.5%

$ 1,520

Lisbon

>0% to 1.9%

1.6%

$ 1,330

Bangkok

>0% to 1.9%

9.1%

$ 1,050

Mumbai

>0% to 1.9%

10.3%

$ 1,140

Miami

>0% to 1.9%

4.9%

$ 1,510

Beijing

0.0%

2.1%

$ 1,520

Shanghai

0.0%

4.3%

$ 2,060

Los Angeles

-1.9% to <0%

-2.2%

$ 1,550

Berlin

-1.9% to <0%

-3.5%

$ 1,150

Seoul

-1.9% to <0%

0.8%

$ 1,730

Guangzhou

-1.9% to <0%

2.1%

$ 1,510

Hangzhou

-1.9% to <0%

0.9%

$ 1,230

London

-1.9% to <0%

-0.9%

$ 1,920

Paris

-1.9% to <0%

-2.7%

$ 1,550

Shenzhen

-1.9% to <0%

-4.9%

$ 1,530

New York

-1.9% to <0%

-3.7%

$ 2,560

San Francisco

-3.9% to -2%

-6.1%

$ 1,400

Singapore

-3.9% to -2%

1.3%

$ 1,800

Hong Kong

-10% or lower

-2.0%

$ 3,970

Source: Savills Research

Suffering from weaker sentiment associated with higher interest rates and the challenging economic backdrop, the prime residential markets of Los Angeles, New York, San Francisco, Seoul, London, Singapore, and Hong Kong are all forecast to see price falls this year.

Sellers says, “We expect it to be a year to watch the markets globally. Countries which account for approximately 40% of the global population will go to the polls this year, and housing will likely be front of mind for many voters and policymakers alike. The potential for central banks to also cut interest rate during mid to late 2024 may also boost activity across prime property markets and could surprise on the upside for pricing in the latter part of the year.”

Rental performance and yields

Dubai also recorded rental price increases during the year at a little under 10%, versus the average 5.1% recorded among other global cities in the Savills index.

Lisbon led prime rental growth among the 30 cities in the index, increasing 39% last year.

Commenting on rentals, Sellers said, “In the face of economic uncertainty, the prime residential rental market proved resilient in 2023. Continuing a trend from the past year, prime rental value growth outpaced capital values, largely driven by a lack of stock in global prime markets and increased levels of demand from individuals and families who would look to purchase a property, but are holding off until the economic and interest rate situations stabilise.”

In terms of yields, Dubai stands out as a high yielding city by world city standards, with returns of 4.8%. Across all world cities, prime gross yields stood at 3.1% as global rental markets recorded stronger growth than the sales markets.

The cost of buying, holding, and selling a property in Dubai is also among the lowest, at less than 10% of the property purchase price, versus 15%, on average, across the 30 global cities.