Yet experts caution that neutrality may prove elusive in the months ahead, especially if the bitter sparring between Washington and Beijing over tech and trade issues intensifies.

Malaysia was left in an uncomfortable bind.

“Being pressured by one major trading partner on economic [cooperation] against another is a major concern for Malaysian policymakers,” said Thomas Daniel, a senior foreign policy fellow with the Institute of Strategic and International Studies Malaysia.

“Given the geopolitical realities we face, however, it is a prospect we must plan for. It will require no small amount of grounded planning, deftness in diplomacy and fortitude to uphold our interest.”

Experts warn that snubbing Chinese firms to appease Western governments could carry dire trade consequences for Malaysia, given its deep economic ties with China. Malaysia’s trade with China totalled 450.8 billion ringgit (US$96 billion) last year – accounting for 17.1 per cent of the Southeast Asian nation’s total trade and nearly double its volume with the US, according to Malaysian government data.

More than one-fifth of the country’s imports were shipped from China last year, ranging from electronics to machinery, chemicals and equipment.

These in turn feed Malaysia’s all-important manufacturing sector, which produces more than 85 per cent of the country’s exports.

But some analysts believe Malaysia can extract even more value from its relationship with China and its 1.4 billion-strong population.

“It’s a large economy, and a very open economy. Sure, China’s growth will be affected by [population] fragmentation, but it [the population] will continue to be an economic driver,” said Cassey Lee, coordinator of the regional economic studies programme at Singapore’s ISEAS-Yusof Ishak Institute.

While Malaysia’s economic performance took a hit from China’s near total shutdown during the pandemic and its slower-than-expected recovery, Lee said the sheer size of China’s domestic market and its political stability would provide long-term payoffs.

“There’s a bit of doom right now because you have business cycles that affect trade volume in both countries … but if you look forward another 50 years, China will continue to be an important trade partner to Malaysia,” he said.

Malaysia has already learned first-hand the risks of over-dependence on Chinese investment.

It was billed as a flagship belt and road project, but has now become a largely uninhabited eyesore after developer Country Garden suffered a cash crunch on the back of capital controls imposed by China’s government, frightening off buyers.

“A slowdown in China might affect trade in [Southeast Asia], especially in the volume of the region’s exports to the country and the volume of strategic investments by China in the region,” said Collins Chong Yew Keat, an international-affairs analyst with the University of Malaya.

“There needs to be a strategic and careful calculation of the future of the economic transformation of the country and the region, taking into account the geopolitical and economic changes of both the US and China.”

Stalled China-linked construction projects also pepper the landscape of Kuala Lumpur, where hollow superstructures occupy prime locations around Malaysia’s capital with little indication of progress after the promised influx of Chinese consumers never materialised.

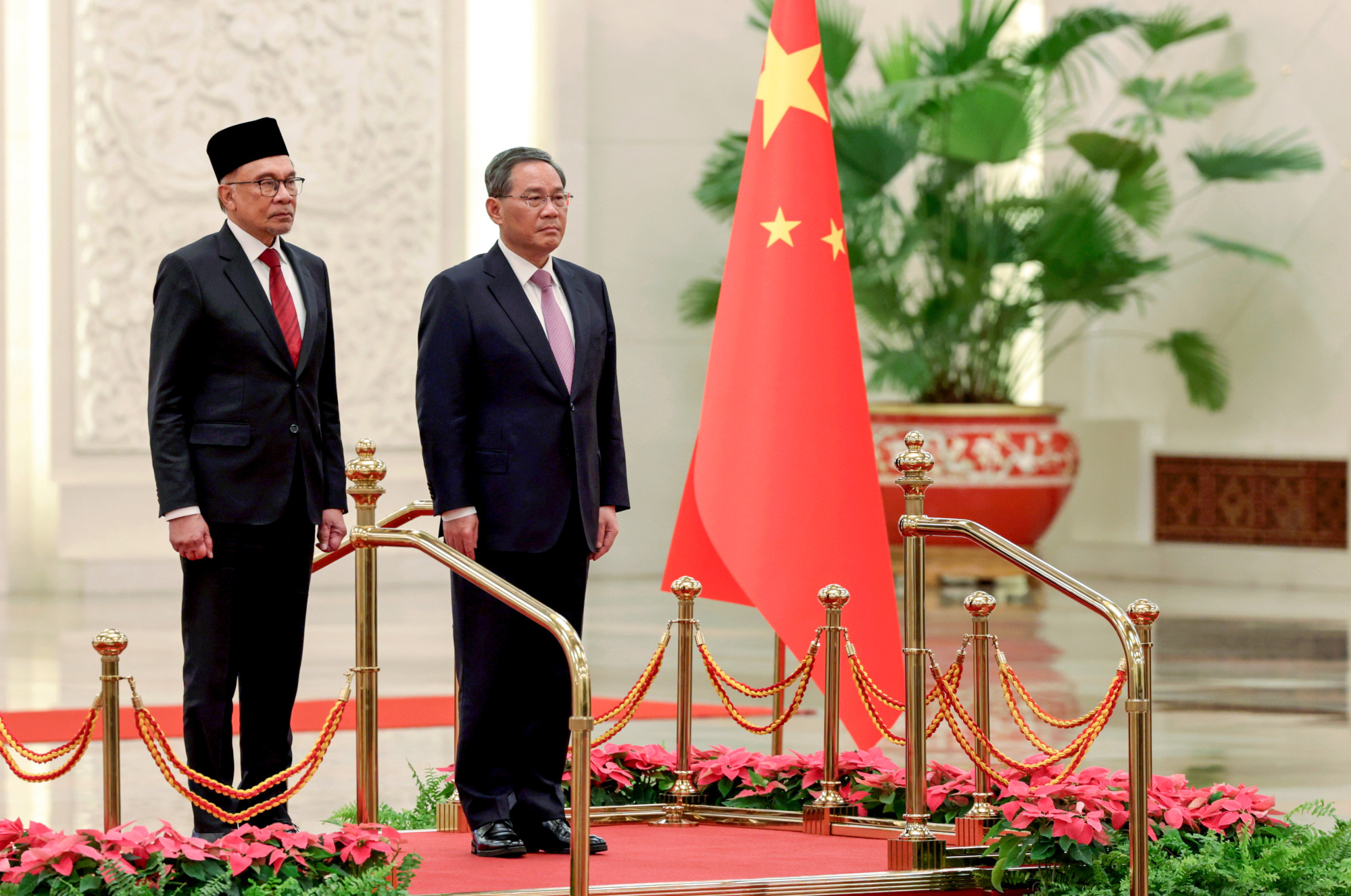

During his three-day visit scheduled for June 19-21, Chinese Premier Li is expected to meet with Malaysia’s top leaders, including an audience with the king and meetings with Anwar and the parliament speaker.

Pupil turns master

But ties between the two Asian nations were not always so cordial.

The conflict went on for decades, leaving a deep sense of distrust of China and of Malaysia’s ethnic Chinese community, even after the Malayan Communist Party formally surrendered in 1989.

But the insurgency did not stop Malaysia’s second prime minister, Abdul Razak Hussein, from visiting Beijing in 1974 and declaring the start of diplomatic relations alongside China’s then-premier Zhou Enlai.

“Despite the apparent reasons for refrain – our ideological chasm, our seemingly irreconcilable differences – our leaders dared to think beyond convention and took a bold leap of faith. This audacious move has blossomed into a rich and fruitful partnership,” Anwar said on Friday in a statement commemorating 50 years of diplomatic ties.

It was during this time that Malaysia extended economic and technical assistance to China, helping get its economy and industries off the ground. A few decades on, the pendulum has decisively swung in the other direction.

“Today, we are asking Chinese entrepreneurs to invest in Malaysia, through various initiatives and programmes like the Belt and Road Initiative,” Senate Deputy President Nur Jazlan Mohamed told parliament on Thursday during a seminar to mark the 50th anniversary of Malaysia-China ties.

“In the past, they did not have skilled contractors. Just 30 years later, they can carry out mega projects in Malaysia and help us reinvigorate our economy.”

Despite the domestic political aggravation, the ISEAS-Yusof Ishak Institute’s State of Southeast Asia 2024 report found that fewer than half of the Malaysians surveyed believed China’s economic rise to be worrying – a sharp decline from 61.7 per cent just a year earlier.

The study also found growing acceptance of China’s regional, political and strategic influence among Malaysian respondents at 43.8 per cent, nearly double the 27.3 per cent rate from 2023.

“This has been 50 years of walking hand in hand. High-level exchanges between the two countries have become increasingly frequent, building solid mutual trust and deep friendship,” China’s ambassador to Malaysia, Ouyang Yujing, said in an opinion piece run by national newswire Bernama on Friday.

Turning a blind eye?

China’s foreign ministry said at the time that it was “fishing season” in the contested waterway.

Malaysia’s decision to dial down its public opposition to Beijing’s South China Sea actions in recent years has been widely seen as a pragmatic approach – more so as Anwar’s administration seeks to bolster the economy after years of atrophy.

“You cannot sharpen the pencil on both ends. So you can only maximise and shout about what you gain, and minimise and keep quiet on what you lose when dealing with a superpower,” said Oh Ei Sun, a senior fellow with the Singapore Institute of International Affairs.

Lee of the ISEAS-Yusof Ishak Institute agreed, saying that China’s aggressive moves in the South China Sea do not yet warrant a “black-and-white position” from Malaysia, which still needs the superpower’s trade and investments.

“They [Malaysian authorities] say they have detected some fishing trawlers, or there has been overflight by their [Chinese] planes … but those are not worth losing the billions in trade and investments from China.”

But Malaysia’s pragmatism may not last forever, especially if it intends to explore more of the rich oil and gas deposits in the parts of the South China Sea it claims sovereignty over.

The challenge, of course, is in whether Malaysia might have reached the limit of its current approach

The Southeast Asian nation has managed to extract most of what it considers important from the waterway so far, according to Thomas from the Institute of Strategic and International Studies, even if it had had to deal with “increased harassment” while making sure not to escalate the issue.

“The challenge, of course, is in whether Malaysia might have reached the limit of its current approach,” Thomas said, adding that “this will largely be determined” by China as it “controls and decides on the facts on the ground”.

But Malaysia may have a few tricks left up its sleeve yet.

Even as successive leaders have emphasised the country’s close ties with China, Malaysia has remained steadfast in its neutral stance amid the ongoing diplomatic tensions between Washington and Beijing.

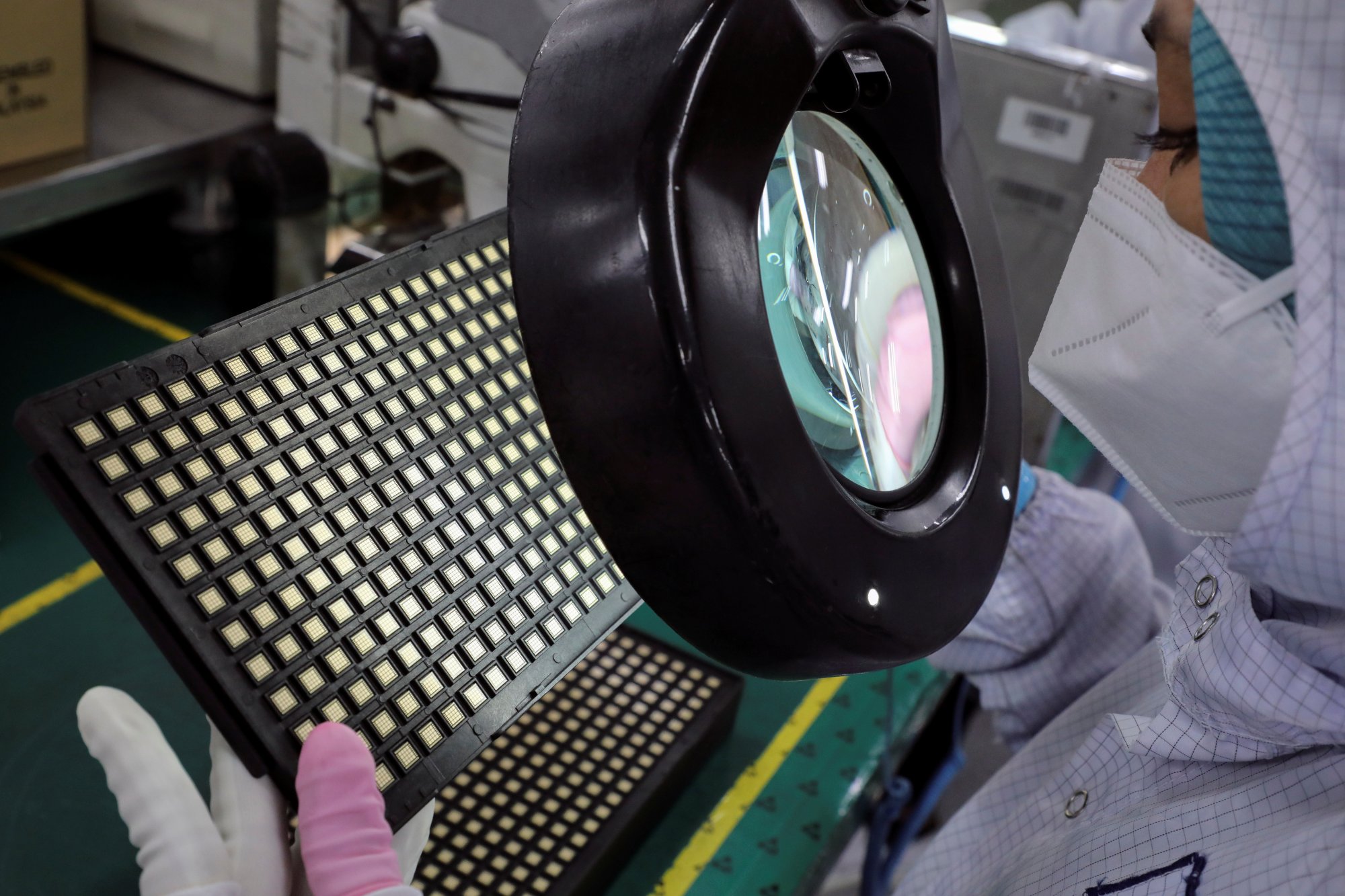

That neutrality will become increasingly important for Chinese enterprises – as well as any business with interests in the global tech and semiconductor supply chain – as Washington presses ahead with sanctions on China, accusing it of spying and developing technology that threatens US national security.

Malaysia already accounts for around 13 per cent of global demand in the semiconductor assembly, packaging and testing sector, according to government data. Its ability to balance the interests of the US and China could help it mitigate disruptions to global supply chains, making it an attractive destination for companies – and their affiliates – from both of the sparring superpowers.

“Malaysia’s ability to stay neutral could make it attractive as a key FDI definition for European and American companies, and even Chinese companies,” ISEAS-Yusof Ishak Institute’s Lee said.

.jpg&h=630&w=1200&q=75&v=20170226&c=1&w=350&resize=350,250&ssl=1)

:max_bytes(150000):strip_icc()/flight-attendant-end-of-year-picks-tout-a85cbff14f244439ab38dc6375e212e4.jpg?w=120&resize=120,86&ssl=1)